Crypto in Hawai‘i Is Still a “Lab” Experiment

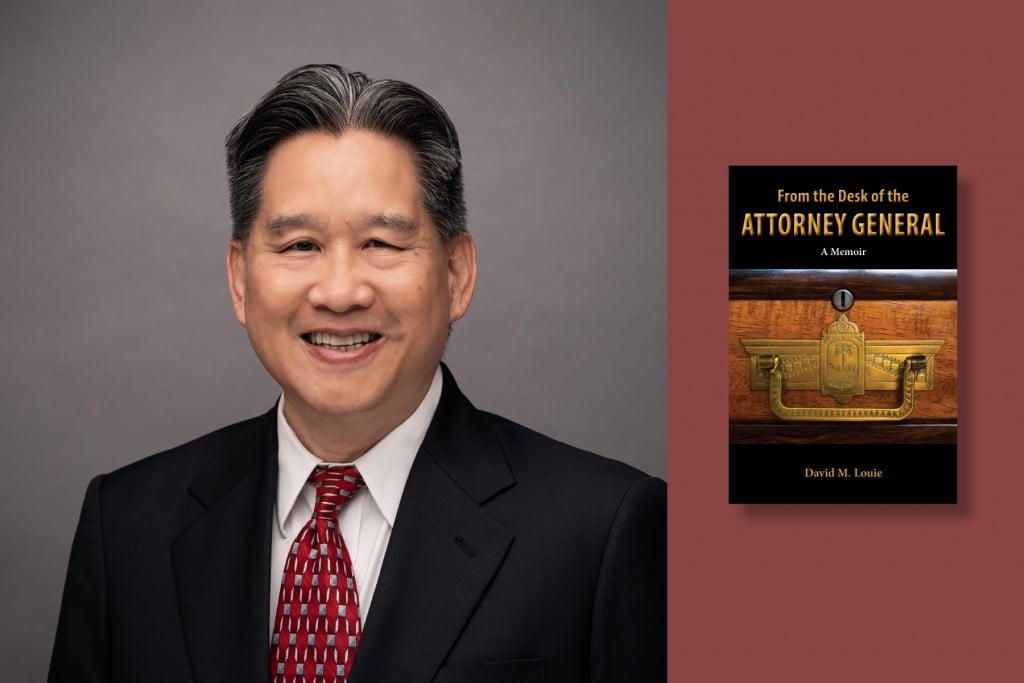

Eleven companies participate in the Digital Currency Innovation Lab while the state explores regulations and advocates push for open markets.

Cryptocurrency remains a “lab” experiment in Hawai‘i, with 11 companies providing digital currency services in the state as part of the Digital Currency Innovation Lab. The lab, scheduled to end last summer, was instead extended until Dec. 30, 2024.

House Bill 2108, designed to help create a new regulatory framework in Hawai‘i, made it all the way to conference committee in the last days of the 2022 Legislature but never passed. State Sen. Glenn Wakai, who has introduced cryptocurrency legislation in the past, says he doesn’t plan to introduce new legislation during the 2023 Legislature.

“The state should be very deliberate in how it grows the crypto market in Hawai‘i. So many people got hurt and swindled. It’s the government’s obligation to protect the public from bad actors,” says Wakai.

Ryan Ozawa frequently reports on cryptocurrencies as the news editor for Decrypt, an online news platform that aims “to demystify the decentralized web.” He also once provided community engagement services for the digital currency lab, though no longer serves in that role.

He strongly supports greater access to digital investments.

“In the absolute freedom model, you do whatever you want but you could also lose your house. In the consumer protection model, you have to jump through hoops, but you’re less likely to lose your house. I see both sides of it. I believe in the ‘buyer beware but have freedom model,’ ” he says.

Nathaniel Harmon, CEO and co-founder of OceanBit Energy, a local Bitcoin mining startup, however, says well-built rules would benefit local communities.

“We need good regulation here in the state. These exchanges, if they’re selling Bitcoin, it’s just a commodity. It’s like buying or selling steel or buying and selling gold. Everything else is a security. Its value is dependent on the work that the company does, and the utility the company provides, so we should have strict regulation around these unregistered securities,” Harmon says.

Recommended: Bypassing the Bitcoin Blockade

Centralized vs. Decentralized

Some advocates of cryptocurrency emphasize the distinction between centralized exchanges and decentralized cryptocurrencies.

Cryptocurrency exchanges are companies that let customers trade cryptocurrencies for other assets, such as conventional money or other digital currencies. Exchanges may accept credit card payments, wire transfers or other forms of payment in exchange for digital currencies or cryptocurrencies.

FTX is one example of a centralized cryptocurrency exchange; it was run by Sam Bankman-Fried and is now in bankruptcy, and Bankman-Fried has been charged with fraud, money laundering and other crimes.

However, there are decentralized cryptocurrencies in which transactions are user-based and user-controlled. Some of the best-known cryptocurrencies, such as Bitcoin and Ethereum, are decentralized. Such cryptocurrencies can also be traded on most exchanges, centralized or decentralized.

Cryptocurrencies can also be bought and sold by individuals in Hawai‘i through companies participating in the Digital Currency Innovation Lab. They can use online exchanges and brokerages, and other platforms such as some ATMs in Hawai‘i.

Lab director Iris Ikeda, who is also the state’s commissioner of financial institutions, says the lab was formed to study the use and effectiveness of cryptocurrency companies – and whether or not they should be regulated.

Liam Grist is the founder of Cloud Nalu, a Hawai‘i-based company that is participating in the lab and provides “a brokerage application for buying and selling Bitcoin while prioritizing holding your own keys (self-custody).” He says HB 2108 could have been a “double-edged sword” by providing easier access to cryptocurrency and trading practices, while also allowing unfairly leveraged and shady exchanges like FTX to operate in the Islands.

Ikeda, however, says added protection provided by HB 2108 would have been helpful to consumers.

Awaiting Federal Regulation

Grist says, “Regulation coming from our national government, or the (U.S. Securities and Exchange Commission), will have a bigger impact on the crypto industry – more than any legislation Hawai’i can come up with.”

Ozawa agrees that Hawai‘i should hold off on legislation until the federal government creates a national framework. “There is no doubt there will be government action,” he says.

The regulatory climate for cryptocurrencies currently varies from state to state.

Grist would like to see a greater acceptance of digital currency by Hawai‘i’s banks. That acceptance, he says, would help residents and the local economy, and each bank would become a “beacon of hope” by safely storing individuals’ cryptocurrency investments.

“The only way we can really change the future is by engaging and integrating with and building a new system founded on better incentives, founded in real, hard money. It’ll take awhile, but it’s an important thing to do,” Grist says.

Ikeda says the lab will continue to allow digital currency transactions and will continue to conduct research that could show the benefits of crypto, including economic development.

Recommended: Bypassing the Bitcoin Blockade

While Harmon and Grist both support the lab and a regulatory framework, they also believe a decentralized blockchain like Bitcoin should be viewed differently.

“The difference with Bitcoin is that you can actually hold your own keys to that Bitcoin,” Grist says. “You can hold your own property, and nobody can control it. I hope it (the lab) will help legislators decide in the future, (that) when we come up with bills in support of digital currency, we separate Bitcoin from crypto because they are two very different things.”

Harmon adds: “Bitcoin has no leader, no company behind it. It’s fully decentralized and sets the bar. The vast majority (of cryptocurrencies) are scams. … If you’re a Bitcoin-only exchange, there should be a different set of laws than being an unregistered securities exchange.”