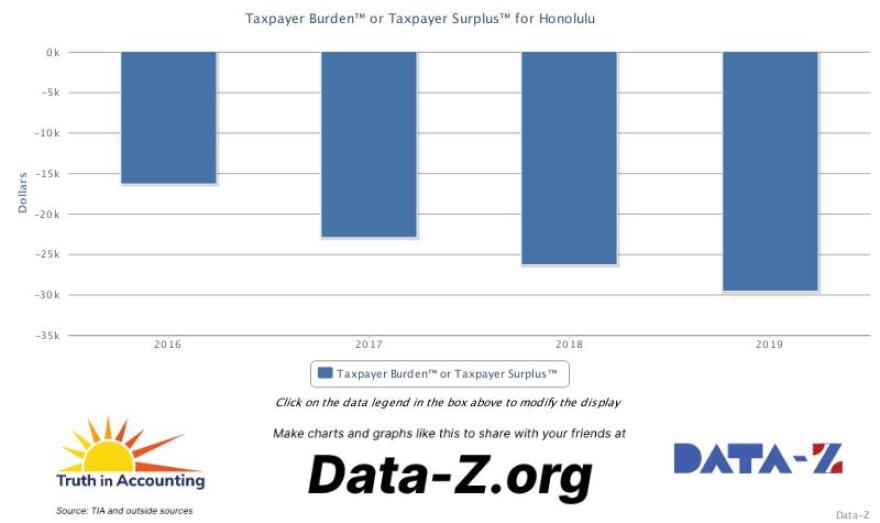

Oahu households would each have to pay an additional $30,000 in taxes to fully cover the City and County’s future obligations.

The City and County of Honolulu’s balance sheet is in rough shape.

That is the assessment of Truth In Accounting, a non-partisan think tank that promotes transparency in government financial reporting.

In its annual report on the financial health of cities, the Chicago-based group found that Honolulu city government has the third-worst finances of any major American city.

That conclusion was reached by comparing the value of unfunded debt to total residential population.

Truth In Accounting Founder and CEO Sheila Weinberg says Honolulu is what she calls a “sinkhole” city; a municipality that has more debt than they have assets available to pay that debt.

In fact according to Weinberg’s analysis, only Chicago and New York City are in a worse position than Honolulu.

She told HPR that each Oahu household would have to pay an additional $30,000 dollars in taxes just to balance the City and County’s check book for expenses already incurred.

“That represents the amount a taxpayer is going to have to pay in future taxes and they’re not going to receive any goods or services on that money because those are bills the government has already incurred,” Weinberg explained.

According to the Truth In Accounting analysis, Honolulu is in debt to the tune of $3.5 billion dollars, with most of that figure representing future pension and healthcare obligations to city employees.

Weinberg says the Honolulu’s elected officials have not been fully-funding the cost of retirement benefits promised to current city workers.

“They’ve only put aside 55 cents for every dollar of pension benefit they’ve promised and they’ve only put aside 24 cents for every dollar of retiree healthcare benefits,” Weinberg noted.

Most U.S. cities are required to run balanced budgets year-over-year. Section 3-112 of the Honolulu City Charter directs the City Council to “enact such measures as will yield sufficient moneys, together with available surplus and other available moneys, to balance the budget.”

However, according to Weinberg government accounting rules typically do not require retirement costs be included in annual budget expenses, since those are costs due in the future rather than the budget year.

But she cautions that underfunding pensions is like not paying the credit bill every month.

“You may be only making the minimum payments and have a plan to pay it off over time, but you still owe that credit card balance.”

When hard times hit, such as the COVID-19 pandemic and ongoing recession, state and local governments often defer even more payments. Hawaii lawmakers are considering such a move this year to help plug the state government’s $1.8 billion budget shortfall.

The complete financial picture for Honolulu may be even worse. The Truth In Accounting report did not include another large potential cash drain: the city’s troubled rail transit project.

The rail project is at least $4 billion over budget and currently years behind schedule. With millions fewer tourists currently visiting Hawaii and many Oahu residents working and studying remotely, the rail also faces the problem of potentially lower-than-expected ridership.

Read the full report from Truth In Accounting here: